Oregon Exemption Credit 2025 - Solved The December 31,2025 , adjusted trial balance for the, Families may be eligible for a maximum refundable credit of $7,430 on their. If you make upgrades and purchases for home energy upgrades in 2025, you can claim those credits when filing your 2023 tax return in 2025 and your 2025 tax return in 2025. The eitc is for people with an adjusted gross income of up to $63,398 in 2023.

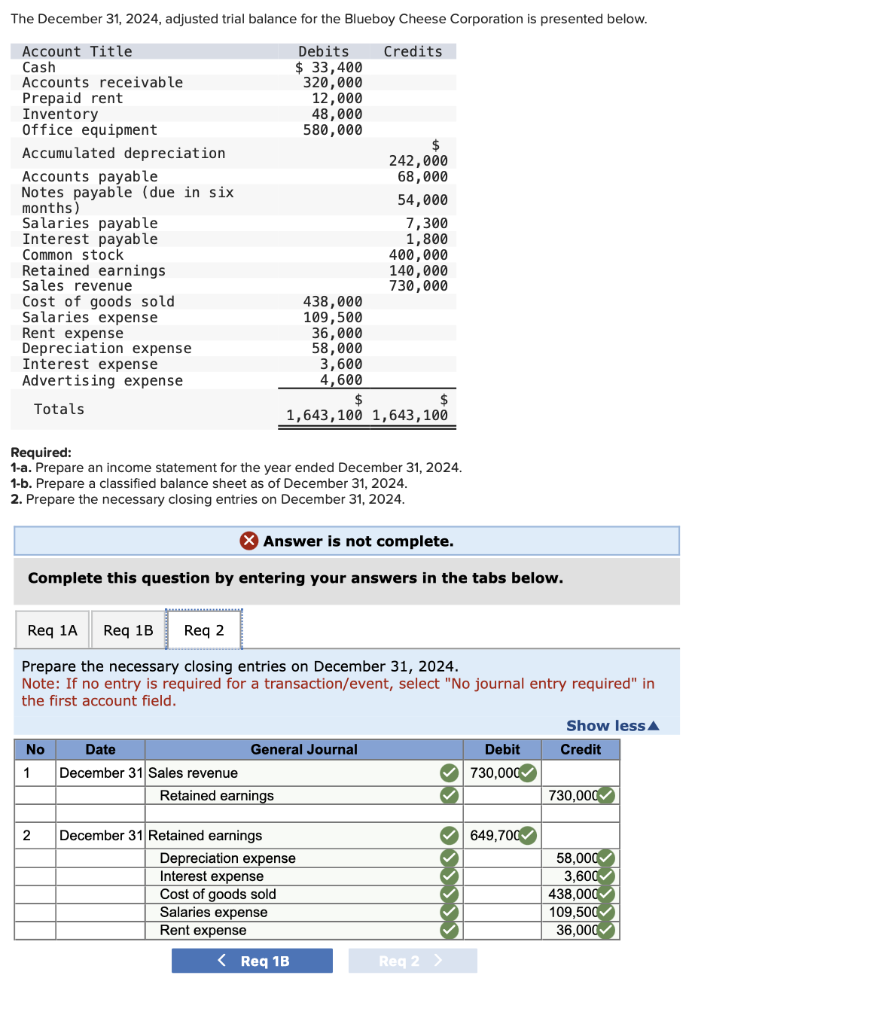

Solved The December 31,2025 , adjusted trial balance for the, Families may be eligible for a maximum refundable credit of $7,430 on their. If you make upgrades and purchases for home energy upgrades in 2025, you can claim those credits when filing your 2023 tax return in 2025 and your 2025 tax return in 2025.

Mastering Your Taxes 2025 W4 Form Explained 2025 AtOnce, The new law provides an available $15 million oregon estate tax exemption for decedents who engage in the active management of natural resource property (. Standard credits can be claimed up to the amount of your tax liability for the year, but any extra amount.

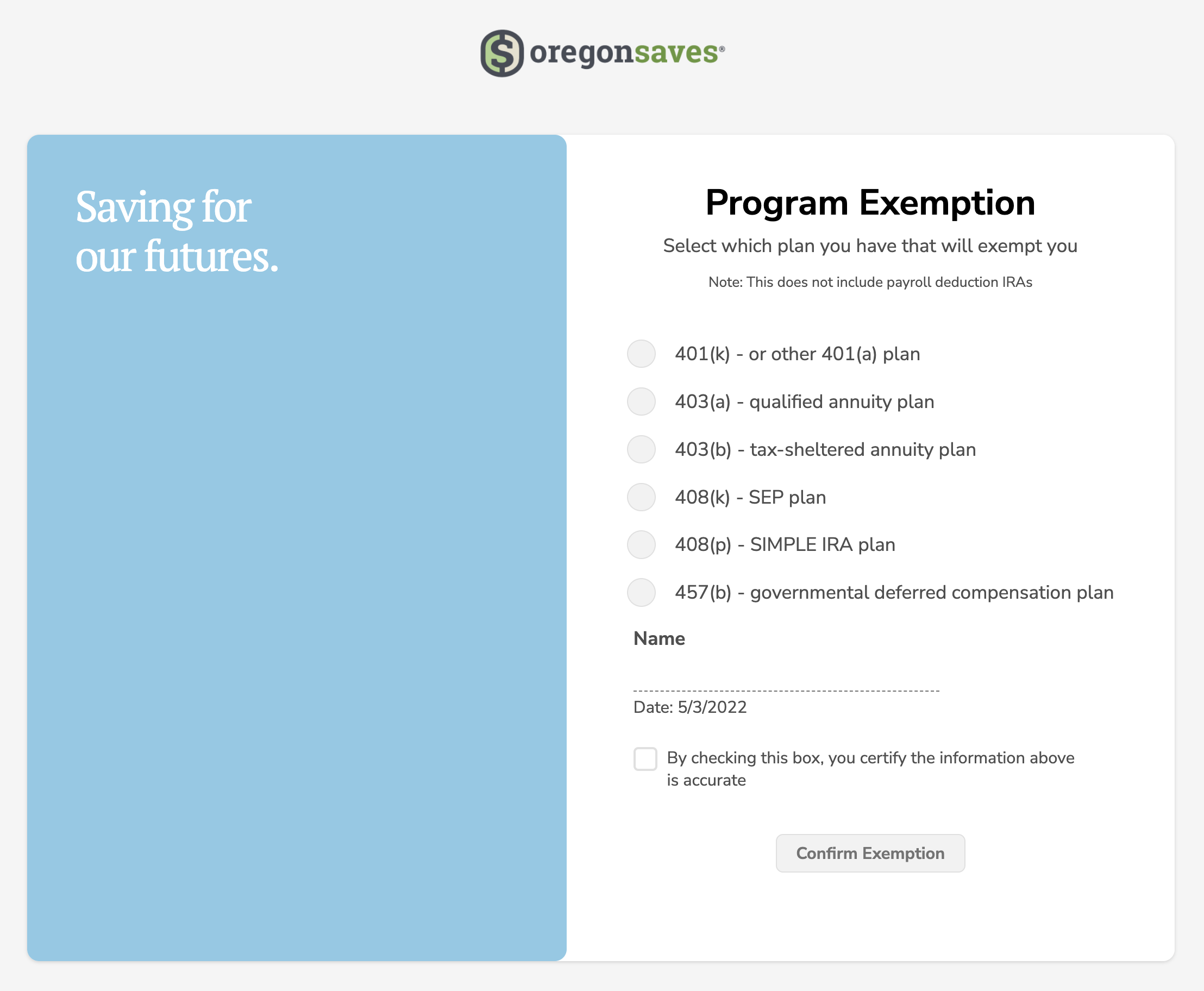

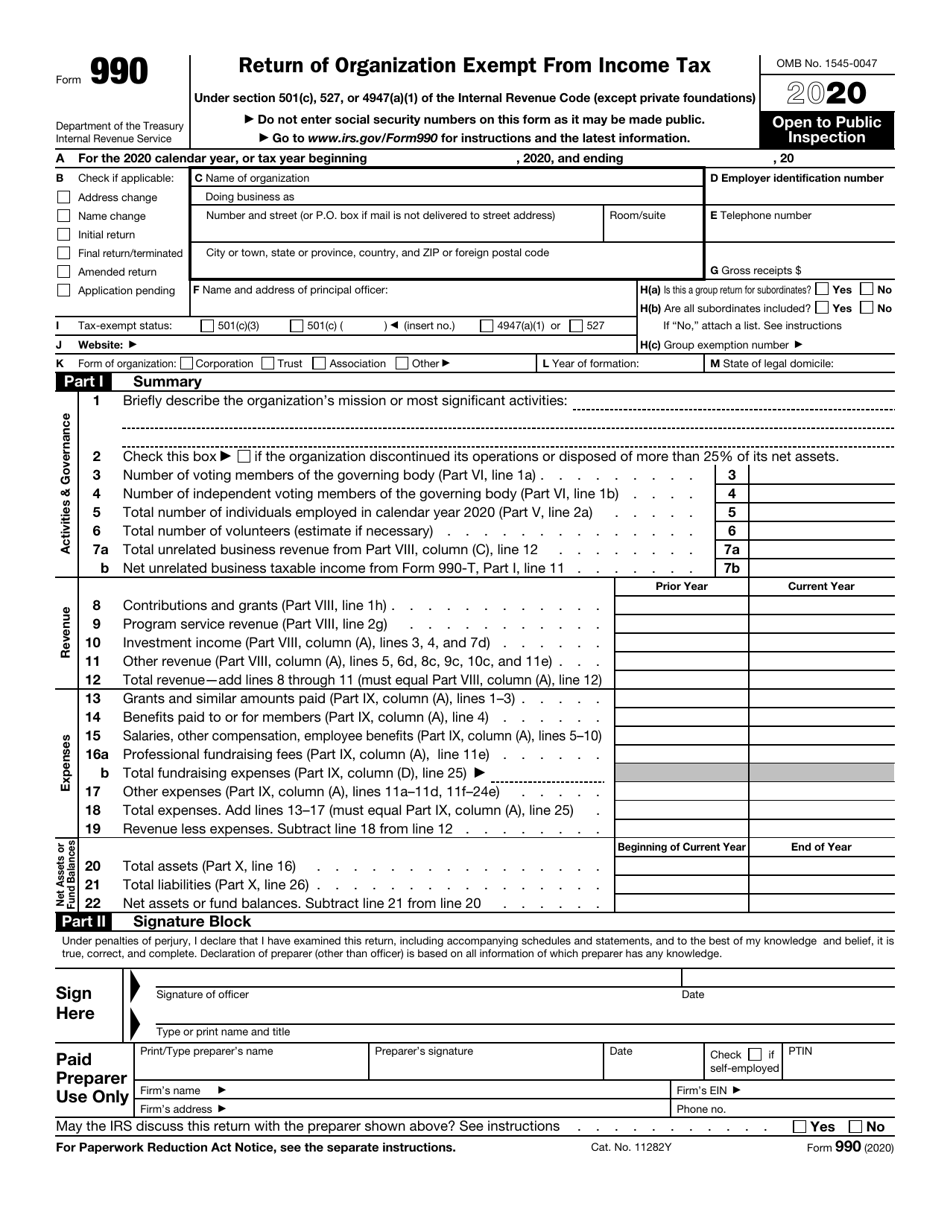

IRS Form 990 Download Fillable PDF or Fill Online Return of, In 2025, eligible oregon taxpayers will receive a “kicker tax credit. Determination of oregon share of income 316.317 credit to beneficiary for accumulation distribution 316.362.

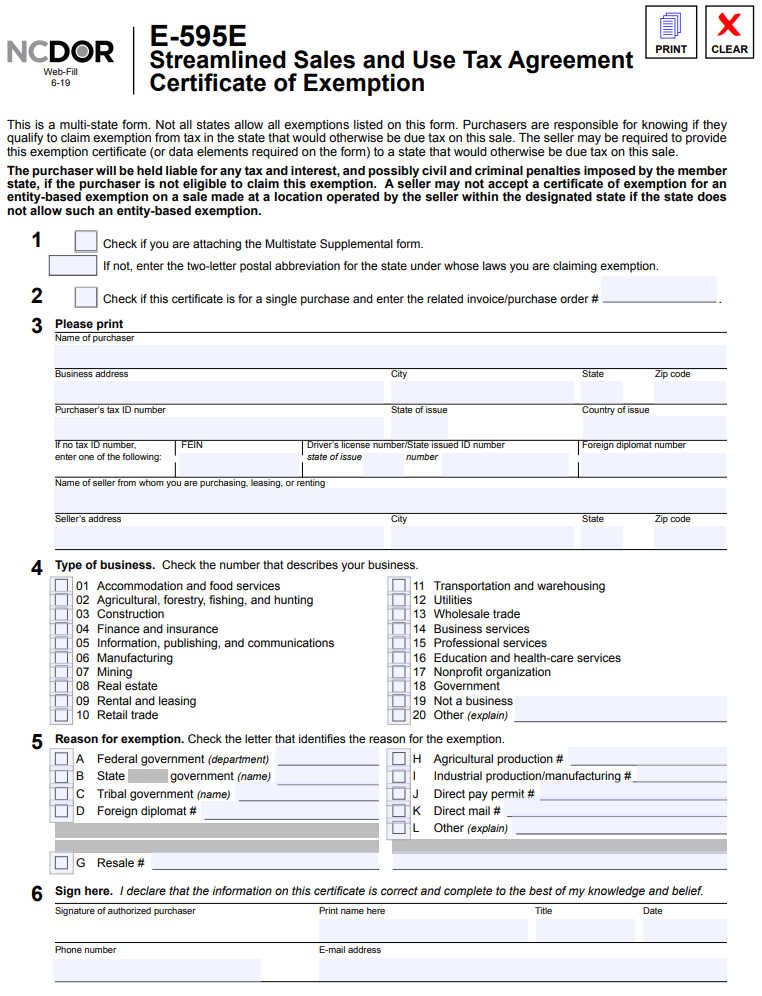

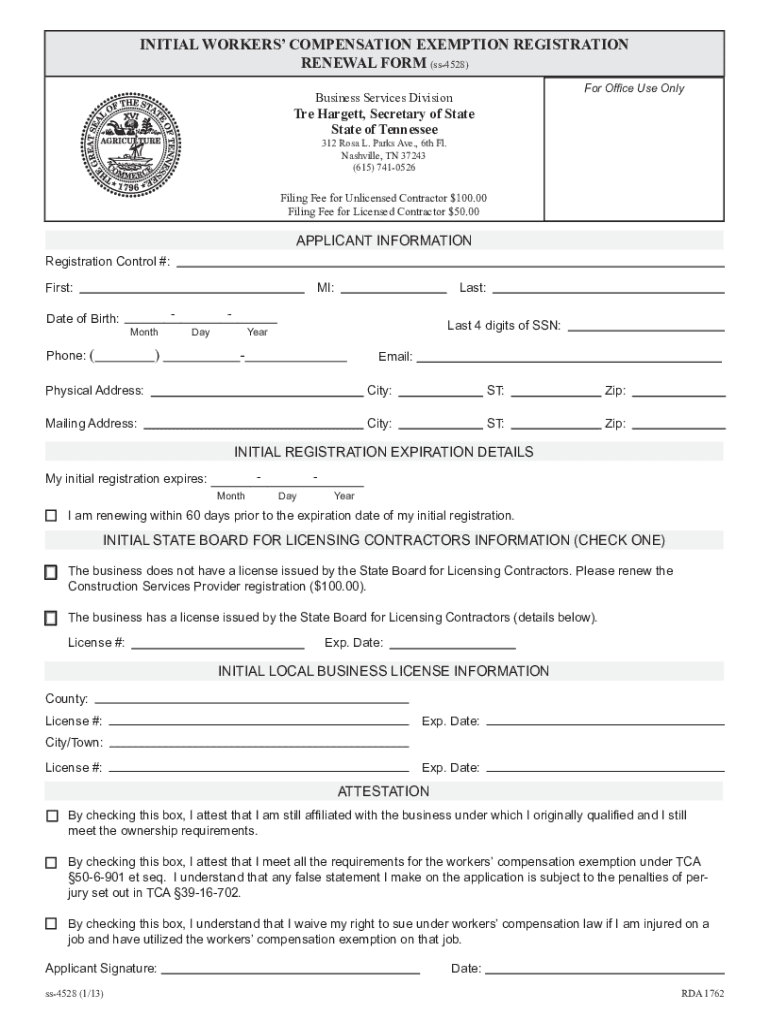

Workers Comp Exemption Tn 20252025 Form Fill Out and Sign Printable, Oregon bankruptcy exemptions help you understand which items such as a house or car are at risk of losing if you file bankruptcy. The agricultural employer overtime tax credit application period for 2023 is now closed.

Oregon Exemption Credit 2025. Additional personal exemption credit for spouse of person with. The credit is fully refundable, meaning eligible taxpayers.

Oregon bankruptcy exemptions help you understand which items such as a house or car are at risk of losing if you file bankruptcy.

Save time and money on Sales tax exemption certificate and Workbooks, The eitc is for people with an adjusted gross income of up to $63,398 in 2023. If you make upgrades and purchases for home energy upgrades in 2025, you can claim those credits when filing your 2023 tax return in 2025 and your 2025 tax return in 2025.

Can Oregon Privilege Tax Be Shifted To Consumer Loup City, A credit may not be claimed under ors 316.758 (additional personal exemption credit for persons with severe disabilities) for tax years beginning on or after january 1,. Proposes an amendment to the oregon constitution to exclude partial exemptions of the assessed value of property, and tax credits against property taxes on property, from the.

These rebates are available for efficiency upgrades (or combinations of upgrades) with demonstrated energy savings of at least 20%, with higher incentives for.

Oregon solar within reach renewable energy systems exemption in. Oregon provides a standard personal exemption tax credit of $ 249.00 in 2025 per qualifying filer and $ 249.00 per qualifying dependent(s), this is used to reduced the.

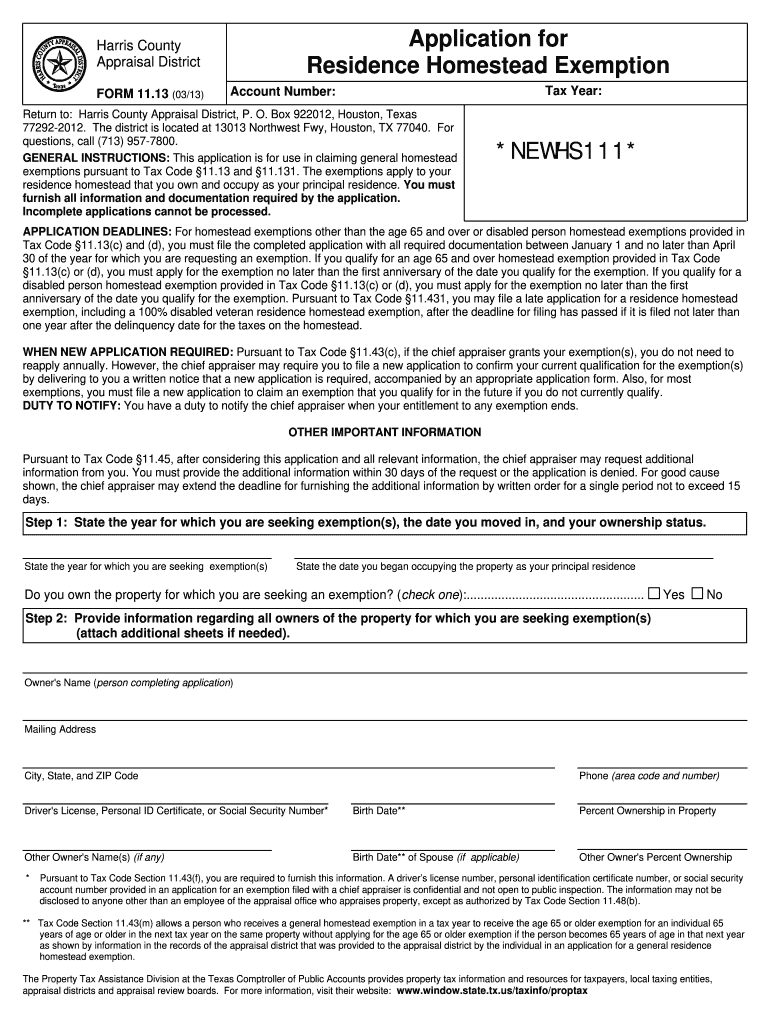

2025 TX Form 11.13 Fill Online, Printable, Fillable, Blank pdfFiller, Determination of oregon share of income 316.317 credit to beneficiary for accumulation distribution 316.362. These rebates are available for efficiency upgrades (or combinations of upgrades) with demonstrated energy savings of at least 20%, with higher incentives for.